Intuitive, Mobile-Optimized Forms

Boost completion rates and eliminate rework by simplifying digital forms. Eliminate pinch and zoom frustrations and provide the very best customer experience by delivering intuitive mobile-optimized forms straight to customers’ cell phones via a text message. Ensure that only required fields are presented, so customers can complete their missing details effortlessly with full data integrity.

PHOTO ID VERIFICATION

Detect Fraudulent ID in Seconds

Determine whether your customer’s ID is authentic by allowing users to submit their passport, driver’s license or other government-issued photo directly from their cell phone — for quick and convenient ID verification. AI algorithms analyze the authenticity and validity of the photo ID to determine whether the document is genuine or fraudulent.

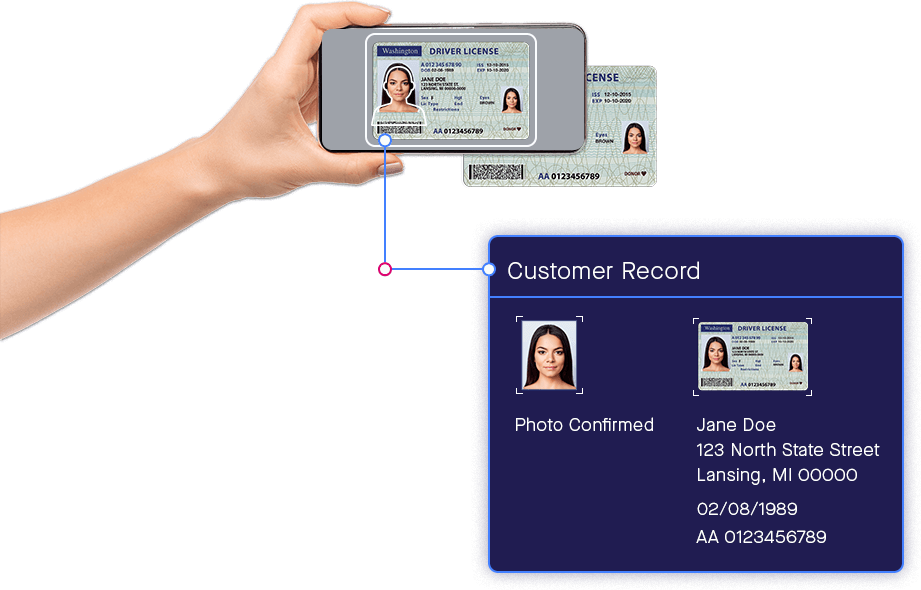

DATA EXTRACTION

Automate The Onboarding Experience

Say goodbye to manually inputting customer data from the collected ID into the CRM. Using OCR technology, Remote F&I is able to extract multiple data points from government-issued ID and documents to be stored in the customer records — including names, dates, images, addresses and more.

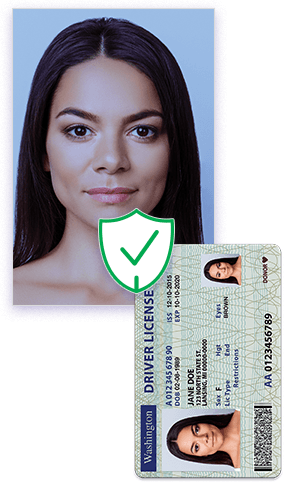

FACIAL COMPARISON IDENTITY VERIFICATION

Ensure Customers Are Who They Say They Are

Make sure your agents are talking to the customer matching the submitted ID by collecting a selfie photo to match with the customer’s photo ID. This enables the agent to confirm that the customer they are speaking to is genuine.

LIVENESS DETECTION

The Most Advanced ID Verification Method to Deter Fraudsters

Worried that when taking the selfie picture, fraudsters might take a picture of a static image of the person they are trying to impersonate? We have that covered. Liveness detection algorithms validate that the captured image is of a live scene, which confirms that the selfie image was taken live.

DOCUMENT COLLECTION & VERIFICATION

Instantly Determine Proof of Customer Information

Simplify onboarding processes by enabling customers to use their cellphones to easily snap and submit photos of documents such as utility bills, proof of income and bank statements in real time.

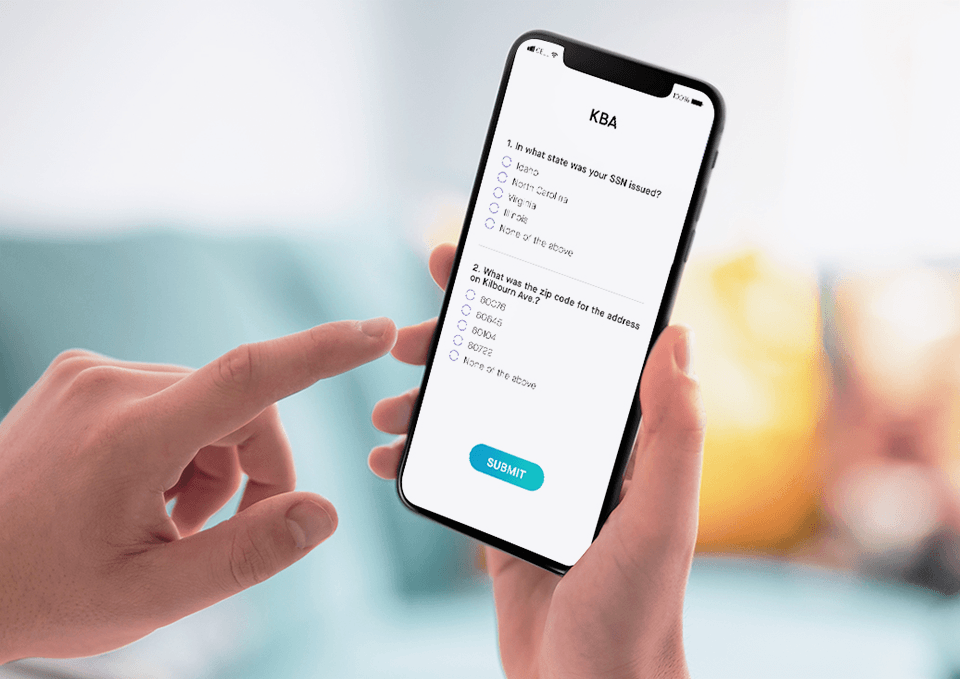

KNOWLEDGE-BASED AUTHENTICATION

Verify & Authenticate Customers Without Friction

KBA is an essential component that requires the knowledge of private information of the individual to prove that the customer providing the identity information is the owner of the identity. Remote F&I uses both static “shared secrets” and dynamic “out-of-wallet” questions to prove the customer’s identity at the start of a Remote F&I session.

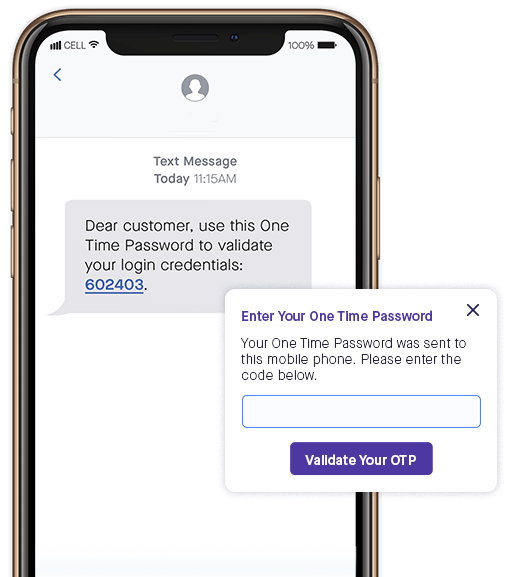

ONE-TIME PASSWORD (OTP)

Protect Your Customers from Fraudulent Replay Attacks

Leverage one-time passwords which require end-users to provide the OTP through both voice and digital channels. OTP is a password or PIN that is only valid for one transaction. In addition, two-factor authentication is used to ensure that the customer is verified over multiple channels, bolstering agents’ confidence in the legitimacy of the customer on the call.

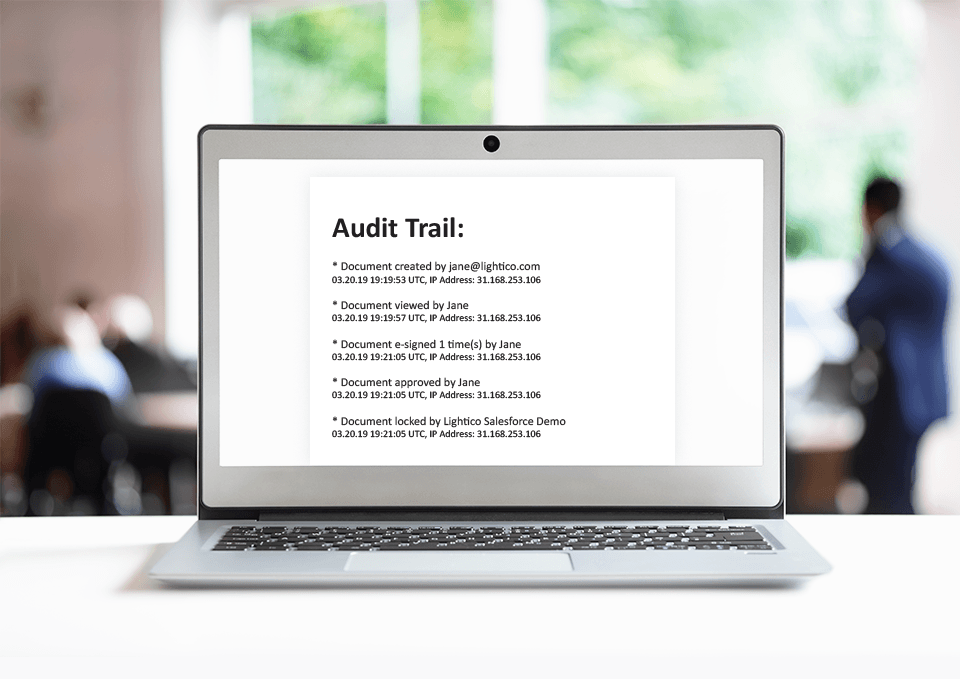

AUDIT TRAIL

Capture a Full Timeline of Time-Stamped Events

Every Remote F&I interaction is recorded with a fully time-stamped audit trail containing details of the type of identity checks (e.g., photo ID and KBA) performed, along with the results. This includes the request/response in JSON format with the details of the check performed.

SMS/TEXT VERIFICATION

Add a Layer of Security to Your Customer Transactions

Verify customers by validating ownership of the mobile phone that they are calling from. The agent sends a text message to the customer’s mobile phone, and when they vocally confirm they have received the text message and click on it, they are verifying that they are in possession of the phone.

DATA PRIVACY

Ensure Compliance and Protect Your Customers’ Information

For elevated risk transactions that involve PPI or other sensitive data, additional layers of verification and security can be added to guarantee customer data privacy. Remote F&I adheres to the toughest security and compliance standards to ensure that all your communication and data are encrypted both in rest and motion.

Benefits

Instant

Customers’ identities are verified in real time from their cell phones. This reduces the need for in-person visits and eliminates the need to chase customers for documents via email and fax.

READ MORE +Frictionless

Smooth and intuitive identity verification and authentication ensures maximum fraud protection and customer security while maintaining efficiency and customer experience.

READ MORE +Agent Guided

Call agents can guide customers through the ID verification process while on the phone to ensure processes are completed instantly. This eliminates any customer confusion and errors that could harm completion rates and turnaround time.

READ MORE +How Remote F&I Photo ID Verification

Can Impact Your Business

Accelerate ID&V for Smooth Onboarding

Stop bouncing your customers around multiple touchpoints like scanners, emails and branch visits to complete compliance requirements. Enable customers to instantly provide ID on-the-go, which can be verified in seconds.

Fraud Detection & Prevention

Protect your organization from fraud with multi-modal spoofing detection, forensic-level forgery, counterfeiting, selfie-to-ID face matching, and risk factor auto-detection.

Enable Effective KYC and AML

Quickly and accurately verify your customer’s identity in accordance with KYC (Know Your Customer) and AML (Anti Money Laundering) requirements and check for potential risks to your organization in seconds.

Schedule Your Live Demo

Instant eSignatures, Payments, Document Collection & More.